High Plains and Rolling Plains. Many counties remove an acre for buildings or a homestead.

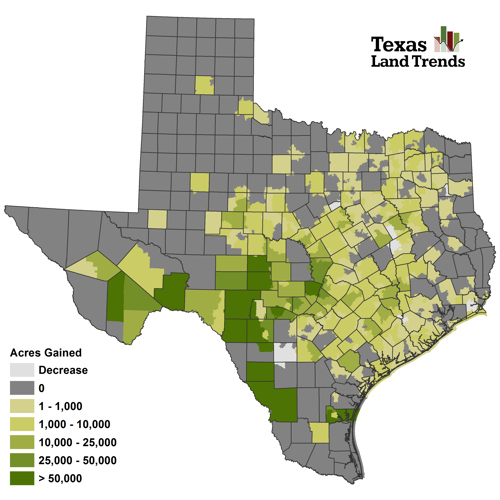

Map Of The Month Wildlife Management Land Use Acres Texas A M Nri

If your property was one size when you paid property taxes on it a year ago and it is still that size when you apply for wildlife then minimum acreage ie.

Texas wildlife exemption minimum acreage. Wildlife Tax Exemption In 1995 Texas voters approved Proposition 11 which allowed for the agricultural appraisal for land used to manage wildlife. This allowed Texas landowners the option of converting their current agricultural exemption to a wildlife exemption if certain conditions were met. Gillespie Central Appraisal District 2012 2.

There are no minimum acreage requirements unless since the previous tax year the landowner has sold gifted or otherwise reduced the size of their ag appraised property. If the tract had Wildlife Management use in the previous year and meets the minimum 10 acres for Ag Exemption then the new owner can continue using Wildlife Management use but a new 1D1 Ag Application must be submitted along with a Wildlife Management Plan. Edwards Plateau and Cross Timbers Prairies.

Wildlife management only a change in the qualifying agricultural practice. The minimum acreage rule for wildlife valuation eligibility is found in the Texas Administrative Code TAC Title 34 Part 1 Ch. The Comprehensive Wildlife Management Planning Guidelines for each ecoregion are provided below and are intended to assist landowners in preparing a wildlife management plan for ad valorem tax purposes.

These additional requirements include. Next the landowner must complete form Application for 1-D-1 Open Space Agricultural Appraisal provide the wildlife management information required and attach form Wildlife Management Plan for agricultural tax valuation PWD-885. No there is no minimum acreage to qualify for a wildlife exemption unless your property acreage has decreased in size last January 1st.

In the second scenario each county appraisal district can set a minimum acreage requirement for wildlife exemption based on the guidelines established by the State of Texas. Here are the details of the Wildlife Valuation in Texas. How To Land In Texas Rethink Rural.

Although commonly referred to as a wildlife exemption the conversion of property from agricultural use to wildlife management should accurately be referred to as wildlife valuation. Agricultural Land Use Guidelines and Standards. Tax Exemptions for Wildlife Management.

For example landowners with a wildlife exemption wishing to incorporate brush control in their wildlife exemption plan should annually treat at least 10 of the area in need of brush management or 10 acres whichever is smaller. One of the most common misunderstandings is how many acres are required in order to move land from traditional Ag to Wildlife Management. Gulf Prairies and Marshes.

Wildlife use requirements does not apply. Rules were created for each ecological region and all of Texas 254 counties were assigned one of these regions. Your tract might be considered if your plan involves a coop or association with adjoining property owners.

Minimum acreage requirement. The landowner has purchased or otherwise acquired property that has been partitioned. In order to qualify for a Wildlife Management Use Tax Exemption you must first have your land under an Agricultural Appraisal or Ag Exemption.

Acreage Requirements There is no minimum acreage requirement for open-spaced agricultural appraisal based on wildlife management use unless the tract of land has been reduced in acreage since January 1 of the preceding tax year. How to determine many acres of pasture are required for your cattle 2018 agricultural wildlife management policy manual texas wildlife exemptions explained what they are and why you want one for your land texasland 43 acres archer city tx property id. Minimum Acreage for Wildlife Management.

101 West Main Street 11 Fredericksburg TX 78624 830 997-9807. By Broker Managing Partner Craig Bowen. Other requirements for wildlife exemption may include meeting minimum acreage requirements if applicable as well as degree of intensity requirements for the chosen management practices that are implemented on the property.

In that case you would need 6 acres to qualify. What is the minimum acreage for wildlife exemption in Texas. Texas Ag Exemption What is it and What You Should Know Dr.

Thats because a property taxed under an ag valuation is not exempt from taxes. This means that any wildlife management valuation property is exempt from the minimum acreage requirement as long as the property is not reduced in size in the previous tax year. Be careful because your home will be assessed for 1 acre and.

Gillespie Central Appraisal District 2012 1. Is There A Minimum Acreage To Qualify For A Wildlife Exemption. If the prospect of sorting through administrative codes already has your eyes glazing over youre not alone.

There are many misconceptions regarding who does and does not qualify for Wildlife Management. You can pick up an application for ag exemption at your County Appraisal District or download one here from the Texas State Comptroller. In short the minimum acreage size for a wildlife exemption varies by appraisal region and county but the minimum acreage requirement only comes into play when a tract of land has been reduced in size.

The Comptrollers Guidelines for Qualification of Agricultural Land in Wildlife Management Use PDF discuss the requirements that land must meet to qualify for wildlife management use to permit special agricultural appraisal as provided by Tax Code Section 23521 and are adopted by the Texas Comptroller of Public Accounts under Comptroller Rules 92001-92005. AGRICULTURAL LAND USE GUIDELINES AND STANDARDS. A Texas landowner interested in obtaining a wildlife exemption must currently be approved for an agricultural property tax exemption.

In Bandera County you must have a minimum of 20 acres of land to qualify for an Ag Exemption. Texas law restricts the property covered by this valuation to between 5 and 20 acres so you must have at least 5 acres to qualify. 43 Acres Archer City Tx Property Id 9552425 Land And Farm.

Minimum acreage requirements will vary between Texas counties but often range from 3 acres for goats and sheep to 20 acres minimum for cattle. Even though we do not have a minimum acreage for each species beyond the 15 acre limit a whitetail deer management plan will not usually be considered on tracts smaller than 100 acres. Blake Bennett Extension Economist Dallas Ag Exemption o Common term used to explain the Central Appraisal Districts CAD appraised value of the land o Is not an exemption Is a special use appraisal based on the productivity value of the land not market value.

Texas Wildlife Exemptions Explained What They Are And Why You Want One For Your Land Texasland Com

Qualifying For A Texas Wildlife Exemption Wildlife Property Tax Exemption

Wildlife Exemption In Texas Wildlife Exemption In Texas